We're running out of Ozempic!

There is an ongoing shortage of GLP-1 drugs like Ozempic, and the reason why is pretty interesting

Last year I covered primarily two megatrends I (and others) saw unfolding in the markets and our daily lives, namely AI and GLP-1s like Ozempic and Mounjaro. AI and semiconductors have gotten the most attention on this Substack, and that is for two reasons, firstly due to the outsized impact it has had on financial markets. Secondly, because I have worked in the AI space for almost 10 years now, so I feel it’s natural for me to talk about it.

In this post, I am going to take a look at a stock that is very different from the ones I have covered so far, and specifically, it is a European mid-cap, in the medical sector making drug containment, delivery, and diagnostic solutions. If none of that stuff makes sense to you, don’t worry, all will be explained.

But first, a recap of what GLP-1s are and what they do.

GLP-1s and “Ozempic chic”

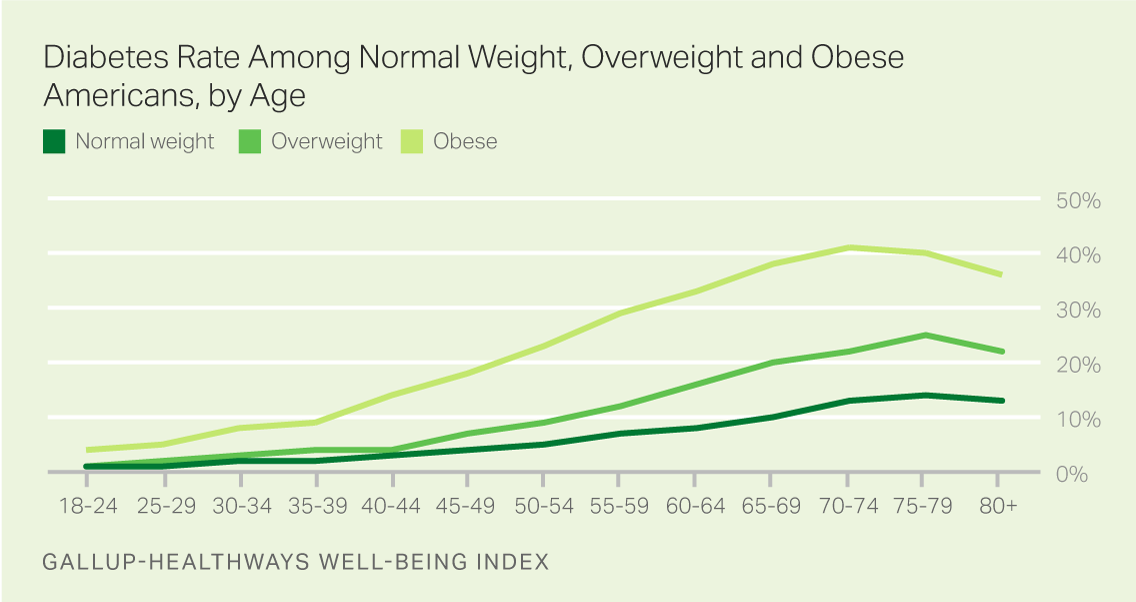

GLP-1s or Glucagon-like Peptide 1-agonists are a type of medication that was originally intended to treat diabetes type 2, but after a while of usage a pleasant side effect was seen: patients started losing weight, and a lot of it. Diabetes is strongly correlated with obesity and being overweight, so in a way it was the perfect testing ground for an efficient weight-loss drug.

GLP-1s work by regulating blood sugar levels, enhancing insulin secretion, and suppressing glucagon release. Other mechanisms of action are that it slows down digestion, and promote a feeling of fullness. This leads to patients eating less and dropping weight fast.

The drug was initially developed by Danish pharma giant Novo Nordisk, who have the rights to the drugs Ozempic and Wegovy. There are other actors in the same space as well, notably, Eli Lilly who are selling Mounjaro and Zepbound. As you can see there are many names for these drugs, and the reason why is simple: FDA approval. Ozempic was the version of the drug approved for diabetes treatment, as such the drug was not approved for use in treating obesity. Ozempic has been prescribed “off-label” quite a lot, meaning it is prescribed for weight-loss, even though it is made for diabetes treatment.

To combat the “off-label” usage Eli Lilly and Novo Nordisk did some intense R&D and made a specific version for weight loss. By intense R&D I mean they changed the name and label of the drug, and presto; you’re swimming in money. For clarity, Ozempic (Novo) and Mounjaro (Lilly) are diabetes drugs, whereas Wegovy (Novo) and Zepbound (Lilly) are for weight loss.

The ability of these drugs to make people lose weight is immense, with the drug itself being mentioned at the Oscars and celebs from Elon to Oprah being avid users. People report losing 20% of their total body weight as a consequence. There are of course side effects, and among the most common are people reporting that they forget to eat, dizziness, vomiting, and so on. The price of beauty I guess.

These drugs are huge (haha) hits, and they are likely to keep getting bigger. There are 750 Million obese people worldwide, of which only 2% are treated and a staggering 42% of the U.S. adult population is considered overweight or worse.

How huge are they?

Ozempic alone accounted for 41% of Novo Nordisk’s total sales in 2023, and two-thirds of these sales came from the United States. Ozempic sales were at $14B USD, and Wegovy sales brought in $4.5B USD. For Eli Lilly the numbers are similar, selling for $18.4B USD in total, up from $9.3B USD in 2022. The only companies with the same sales growth are semiconductor companies (I had to).

I made some observations during the summer of 2023 when discussing these companies which led me to think Eli Lilly would be the winner of the GLP-1 race, and the main reason was that they have a larger production plant. I think Novo was aware of this themselves and as a consequence made an outright acquisition of a CDMO (Contract Development and Manufacturing Organization) called Catalent to expand their production capacity.

An interesting thing to point out here is that Eli Lilly has said that this acquisition is anti-competitive and should be scrutinized. And the reason for it is that Eli Lilly also uses Catalent, and is scared that Novo will restrict their access to extra manufacturing capacity as a competitive tactic. This is very reminiscent of why the big semiconductor players invested in Arm, to not be restricted by their competitors who did invest.

Why is production a big deal?

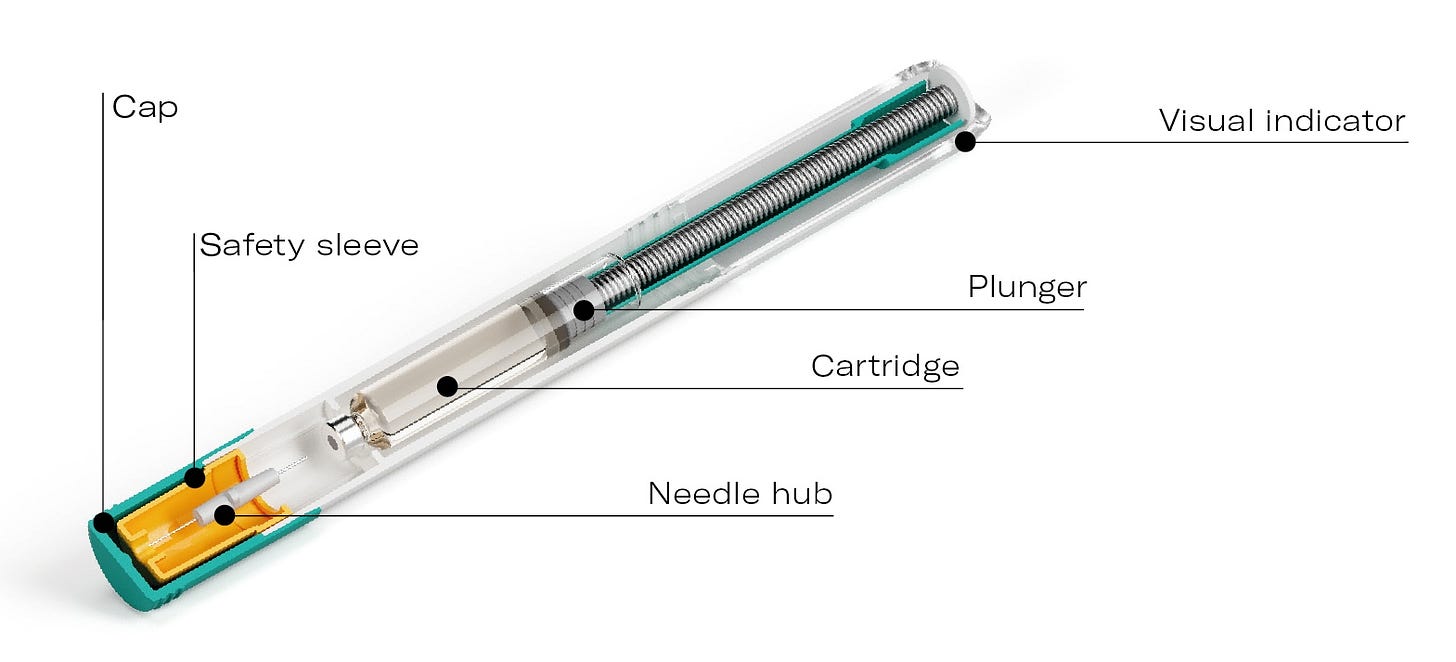

Up to this point we’ve not really talked about the drug manufacturing process, and why manufacturing is an issue at all. GLP-1s are injectables, that patients use once a week, the economics behind injectables are entirely different from oral medication (pills). A pill version of GLP-1 drugs is what both Novo Nordisk and Eli Lilly are working towards, not just because patients are more likely to comply with treatment, but because it is much cheaper.

Production of injectables requires a whole lot more moving parts compared to pill production, which is more of a chemical process than anything else. Injectables require completely sterile manufacturing conditions which continues in packaging, as injectables require specialized packaging to maintain sterility.

In addition to the increased degree of sterility, the ingredient purity generally needs to be higher than in pill form manufacturing, this is due to injectables being just that, injected. Oral medications that pass through the digestive system get some help in filtering out impurities, whereas injectables are administered directly into the bloodstream or body tissue, this bypasses many of the body’s natural defense mechanisms, so any impurities or contaminants can lead to immediate reactions (very bad).

Novo Nordisk acquiring Catalent to keep up with demand sent an important signal to me: we are very early in the process of getting GLP-1s into the hands of more people, and one of the main reasons it hasn’t spread more is production and manufacturing. Which brings me to the real topic of today’s post.

The stock we are going to look at is one that I think has great upside potential, one of the best compared to its peers, has an established relationship with Eli Lilly & Novo Nordisk, and is still growing.

Let’s take a look below the paywall.

Denominazione di Origine Protetta - STVN

No, we’re not talking about tomatoes, but we are talking about an Italian company. We are looking at Stevanato Group S.p.A (NYSE: STVN). STVN is a leading global producer of drug containment and delivery solutions to the pharma, biotech and life science industry.

STVN is the leader in the production of pre-sterilized vials and pen injectors. In 2022 their revenue grew by 17% of which most is attributable to GLP-1 production. Their client base is growing, with 41 of the top 50 pharma companies on the client list and 15 of the top 20 biotech companies as well.

Ok so they know their stuff, what do they do w.r.t GLP-1s? As I said above they are the market leader in the production of pre-sterilized vials, and in this product line we find their cartridge system called the Nexa 3x, named 3x due to its resistance to breaking compared to standard glass cartridges. You don’t need to be a medical glass expert to understand that glass breaking is bad, and 3x stronger glass makes that happen a lot less often. They also make a lot of other products that we will get into further down, but put simply: they make medical-grade glass for injections, and systems related to that.

Production problems

Why is this interesting? For one reason: shortages. As you might have seen there have been supply problems with GLP-1s ever since the drug gained popularity in 2022. Why have there been supply problems? Due to manufacturing constraints. These supply constraints are occurring due to capacity constraints, meaning Novo Nordisk and Eli Lilly can’t make enough of the drugs to satisfy demand. As late as December 2023 the European Medicines Agency stated that there was an ongoing shortage that was expected to continue through 2024.

The reason they can’t satisfy demand is due to what I mentioned above the paywall, manufacturing autoinjector drugs is very different to that of oral medications like pills. To combat these supply problems Novo Nordisk started using a supplier called Ypsomed to manufacture “Large quantities of autoinjectors” and based on my reading, STVN is part of this contract, making the vials for the autoinjector. At this point, I’d be remiss if I didn’t point out that the autoinjector market is way larger than you’d think. It is growing at an 18% CAGR, and is estimated to reach $240B USD by 2030.

Sentiment and financials

I took a look at the last couple of quarterly reports and their prepared statements, all of them reiterate a similar sentiment to Q3 2023:

… We are maintaining our full year 2023 guidance, and we currently see positive long-term trends. We are operating in an environment of favorable demand, growing end markets and multi-year secular drivers.

They are expanding production capability by building new plants in the U.S., and Italy. To my mind, this is mostly to shore up GLP-1 demand. A look at the revenue side shows that the EZ-fill (very imaginative naming) product line is responsible for a big chunk of revenue (33% in Q2 23). The EZ-fill products are the only pre-sterilized solution on the market and are used for GLP-1 production and other biologic drugs.

Biologics are a broad category of products often administered by injection. They can be challenging to stabilize and administer, due to their complexity, sensitivity, and viscosity. As a result, biologics have unique storage and packaging requirements that our EZ-fill, Nexa, and Alba products are specifically designed to address - even for the most demanding biologics.

So the next question has to be “Do they make money?”, and the answer to that is yes they do. On a Year-over-Year basis revenue has increased by 16%, and net income after taxes has also increased by 6% Year-over-Year. The same is true for quarterly results, where there are similar increases of 10% revenue increase sequentially, and 4.5% net income after taxes.

I am extremely bullish GLP-1s, and I think getting some exposure to upstream companies like STVN is a good way to capture the theme of increased demand.

Trading plan

If you take a look at the price action of STVN it can be relatively choppy. I don’t see any reason for this to change near term, but as an upcoming catalysts, earnings will be released this Thursday. Based on all I’ve said above, combined with the current run-rate of Novo Nordisk and Eli Lilly (selling like hotcakes) I am expecting a beat. I have a relatively small position in STVN, which I’ll add to if earnings go my way. I have more capital placed in MRVL, which has their earnings release the same day.

Thesis recap

Before we end this story I want to recap the thesis:

The biggest constraint, to GLP-1 adoption is autoinjector supply making autoinjector manufacturers the “picks and shovels” of this trend.

Autoinjectors is a growing market, with a healthy CAGR of 18%.

STVN are the current market leader for pre-sterilized vials and autoinjection cartridges which are high in demand for GLP-1 usage.

Patients are adhering to the use of autoinjectors without issue. If more patients were scared to use injectors I think the rush towards pill-form medication would accelerate.

In addition to all these points, there is an even more important one to mention: GLP-1s are part of a megatrend that will impact millions and we’ve only seen the beginning of the demand cycle.

Well, I never thought I’d make a post about a medical-grade glass manufacturer, but here we are. Thank you so much for reading and being a subscriber! Your support is very motivating, and I want to thank you all. If you enjoyed this content please like the post and even leave a comment if you can, I’d greatly appreciate it.

I like what you write about the business. But how can you buy a stock without any look at the financials ? I am going to check it for this company and come back to you.

This was so in-depth, I loved the analysis! I was looking at suppliers like Stevanato and I was wondering, where did you find the information about STVN supplying Ypsomed? Like what was the source? Again, this was really great, thanks so much!