Weekly ledger: Ozempic and the road to $100Bn

Novo Nordisk are likely targets of Medicare price bargaining to bring Ozempic prices in line with the rest of the world. Nvidia and Google announce major GPU partnership, and OpenAI releases ChatGPT for enterprise. Grayscale Bitcoin Trust wins against the SEC in landmark decision, forcing regulator to re-evaluate spot Bitcoin ETF.

The US considers price controls for Ozempic💉

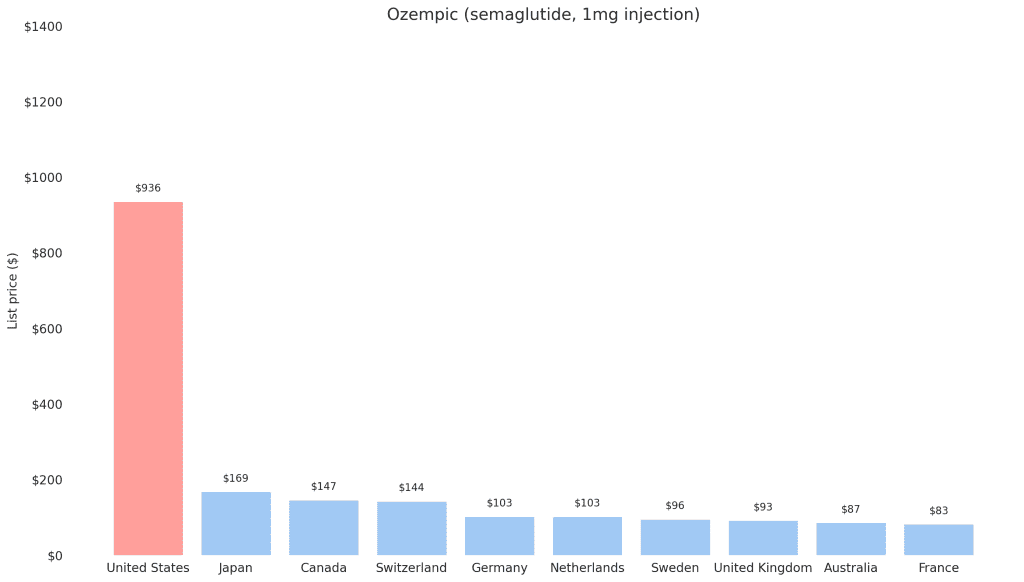

The US differs significantly from the rest of the world when it comes to healthcare. In the EU the EMA (European Medicines Agency) can approve drugs for circulation, and national agencies such as the NHS in the UK will negotiate on price, often comparing to different countries in the region. In the US pricing is determined by the market (the developer) and subsequently private insurers, which there are a lot of, who negotiates prices which leads to higher prices in general.

Ozempic and it’s variants have taken the world by storm, being touted as the wonder drug for diabetes, weight loss, and other positive effects such as decreased cardiac event risk for obese people. The duopoly Eli Lilly and Novo Nordisk (patent holders of GLP-1 inhibitors semaglutide and tirzepatide) have benefited immensely from this, seeing their stock prices spike 17% in one day on the release of good news.

This week the Biden administration has said that 10 prescription drugs will be subject to negotiations with the Medicare scheme in the US. These price controls could see the price of Ozempic (Novo Nordisk) drop significantly, and Bloomberg reports that a 40% cut in price could lower Medicare costs by $1.3Bn USD.

Our Take:

The drugs are here to stay – Ozempic is currently selling so much that it’s influencing the Danish central bank due to the sudden influx of foreign currency. The fact that the US is thinking of negotiating a lower price is a bullish signal to us, meaning we will probably see hightened usage and general availability in the years to come.

Patents are still going strong – The patents for Novo Nordisks’ Ozempic and Eli Lillys’ Mounjaro are secured until 2031 and 2036 respectively, meaning there is loads of time to reap the benefits of world wide obesity.

Eli Lilly will probably be the biggest beneficiary – with clinical trials showing a larger decrease in weight for patients. Analysts are forecasting as much as $100Bn USD in revenue from the semaglutide market per year. Not bad considering Eli Lillys’ revenue was $28Bn USD in 2022. Novo Nordisk currently can’t handle the demand for Ozempic, and will most likely need to invest in production capability to maximise their potential. Eli Lilly has a much larger organisation, and are ready to pump out drugs for the masses.

NVIDIA + Google Cloud = 💸💸💸

NVIDIA continues it’s dominance of the AI space by expanding its’ collaboration with one of the biggest consumers of GPUs in the world, Google Cloud. In a press release from NVIDIA they highlight that Google Clouds new A3 virtual machines are purpose-built to be powered by the now infamous H100 GPUs. Not that these titans haven’t collaborated before, but this takes it to another level. Why is this a big deal? GPU-resources has been increasingly difficult to come by this year with LLMs and other generative models have dominated the scene. As we mentioned in the previous newsletter, NVIDIA have run out of stock of H100 GPUs, and the shortage is forecasted to continue until the beginning of 2024. The Google Cloud VertexAI platform will offer H100 GPUs in the coming weeks, perhaps hinting that the shortage was semi-planned.

In another bit of news, the subtack Semianalysis released an article detailing Googles new LLM, Gemini which has been widely reported as ‘smashing’ GPT-4 on all performance metrics. Although Gemini is trained on Googles own TPUs (Tensor Processing Unit), we find it unsurprising that it and their partnership with NVIDIA is announced simultaneously. It is important to note that Google is the most compute rich company in the world, and while they obviously failed to capture value from the immediate ChatGPT moment, they are extremely well positioned to take advantage of the coming wave of generative AI.

OpenAI releases ChatGPT for Enterprise💻

In order to increase their competitive advantage and to lock in customers to the ChatGPT platform, OpenAI has released ChatGPT for Enterprise this week. Microsoft Azure integrated ChatGPT as a service earlier this year, but this has been mired with quota restrictions, especially for ‘non-important’ organizations around the world. OpenAI themselves have estimated that 80% of Fortune 500 companies have adopted ChatGPT in some way (based on e-mail domain signups), and reports that demand has been unprecedented.

The features of ChatGPT for Enterprise might be a sight for sore eyes for some as it alleviates some glaring security concerns voiced this year:

Customer prompts and company data are not used for training OpenAI models.

Data encryption at rest and in transit

Unlimited access to GPT-4 (no usage caps)

Higher-speed performance for GPT-4 (up to 2x faster)

Unlimited access to advanced data analysis (formerly known as Code Interpreter)

32k token context windows for 4x longer inputs, files, or follow-ups

Earlier this year Samsung experienced a snafoo where sensitive data was leaked on ChatGPT, leading to a company wide ban, this release would bypass that problem by not letting this data be used for training by OpenAI.

Our take:

OpenAI has been the obvious winner of the early LLM race, but we see competition ramping up significantly in the coming months. There are several other startups with people from OpenAI and Google such as Anthropic and Inflection, not to mention the GPU rich companies like Meta and Google themselves throwing themselves into the fray. While ChatGPT has captured the imagination and fascination of many around the world, this does by no means make them safe from competition. We expect shiny object syndrome to kick in, and people will be eager to try other offerings once available. The biggest winners in all of this is the big incumbents like Microsoft and Google, who can make their own models, and incorporate others into their cloud offering. Of course when talking about winners we can’t not mention the “picks and shovels” provider, which of course is NVIDIA.

Grayscale Bitcoin Trust wins against SEC🏴☠️

SEC chairman Gary Gensler has just taken a big L, Grayscale Bitcoin Trust won their case against the regulator allowing them to reapply for listing the trust as an ETF. Some backstory is required: Grayscale launched a Bitcoin trust some years ago, and has since become the biggest BTC fund in the world. This matters because people who didn’t want to buy BTC in the spot market through a crypto exchange could instead simply buy shares in the trust (ticker GBTC) with most brokers. Why call it a trust? Well because the SEC didn’t approve of any BTC spot ETFs, so treating it as a trust is a sort of workaround.

The SEC have not approved any BTC spot ETFs, but they have approved BTC futures ETFs. This irked Grayscale which at one point held over $40Bn USD worth of BTC in the trust. With the court decision coming in tuesday the 29th of August the SEC will have to re-evaluate the petition for the Grayscale ETF, which was re-filed immediately after the decision.

Our take:

This decision comes at an interesting time, Grayscale hoped to be first to market with a BTC spot ETF, but they are certainly not alone in that desire. Many of the traditional finance titans such as Fidelity, VanEck and most notably BlackRock, are all vying to be first. While we feel letting retail investors skip the ardous process of setting up wallets and accounts is a good thing, we don’t think this is risk free. Having a bunch of ETFs tracking the price of real BTC denies the initial promise of bitcoin, where the inability to withdraw the actual asset makes it unusable. We wouldn’t be surprised if the ETFs become more popular then the coin itself.

When it comes to crypto we are big fans of the adage ‘Not your keys, not your coins’, meaning if you can’t take the coins off the exchange and into cold storage, you don’t own it. But hey, I guess it is a nice way for BlackRock, Grayscale and the others involved to harvest some juicy retail fees.

Best Tweets🔥

One of the best Twitter accounts out there Unusual Whales posted a fun fact on OnlyFans, to which a follower had a response that captures our sentiment exactly:

If OnlyFans were public and we had to pick a position, we would be long. Never bet against degeneracy.

What are we looking forward to next week🕵️

Everyone’s favorite memestock Gamestop (GME) release earnings after close next wednesday, as does C3.ai, a big beneficiary of the AI hype that has been going around this year. The stock is up 180% on the year due to the ChatGPT moment. 🦍

Best of r/WSB🚀

Technically a repost but still a teriffic attempt at tax planning in true WSB spirit.