Nvidia and the whale

Another blowout quarter for Nvidia, but there is something lurking beneath the surface...

Nvidia crushed earnings AGAIN in what can only be described as the Super Bowl of earnings, they are the bellwether for the AI hypecycle (potentially bubble) and are the best gauge for how the entire AI ecosystem is doing. In this post, I want to have a look at the earnings and discuss some of my findings after diving a bit deeper than I should have.

Going into earnings I was a bit worried, the main reason was that I was certain that Nvidia would beat expectations, but I wasn’t sure they would beat expectations enough. This sounds like a ridiculous thing to say, but if you look at the post on Complex Adaptive Systems I hope my thinking is a bit more clear.

In a case where Nvidia delivered on street (Wall Street) expectations, I think the stock would have taken a beating. The entire market was watching the earnings with somewhat of a negative slant, so in a way you could say Nvidia saved capitalism (haha). The market experienced a selloff in the days leading up to the report, with Nvidia stock sliding 7% pre-earnings. I think that is meaningful; it shows that there were a lot of people thinking that they were either unsure of how strong earnings would be or unsure of how the market would receive the news.

On to the earnings!

Year-over-year growth in the data center segment is +400%, +26% quarter-over-quarter, and they expect growth to continue. Nvidia’s internal analysis and guide imply revenue of over $100 Bn this year, not bad considering FY2024 revenue was $62 Bn all told. For reference, FY stands for Fiscal Year, and CY stands for Calendar Year.

There is however one thing I need to put out there as a caveat to the data center revenue, which I feel is not oft discussed. Some of the most hungry Nvidia customers are hyperscalers like Microsoft, Google, and Amazon, and a core business segment for these companies is renting out data center capacity. The cloud platforms like Azure are not necessarily buying these GPU’s to perform their own research (they have partners for that) but it is to sell compute to their customers.

Another important point is that the $18.4 Bn of Q4 data center revenue Nvidia had is revenue to them, but it is not an operating expense to the companies that are building out their infrastructure. In a bit of throwback to accounting class (my god), the purchase of these GPUs is not an expense on their income statement, it is booked as a capital expenditure (capex for short) in the cash flow statement, it gets put on their balance sheet, and then depreciated over time.

So they can spend $20 Bn of cash because Google and the like have $100 Bn USD cash sitting on the balance sheet which they have been struggling to put to work. So what do you do with that cash? You build out the next-gen cloud infrastructure.

The same thing happened in the telecom bubble, where a lot of investments went into fiber, but the capacity wasn’t used until much later. This is perhaps the most powerful argument if you were to draw parallels between the telecom bubble and Cisco to AI and Nvidia.

Supply and demand

There are a couple of things to note on what will happen moving forward: Nvidia is in a new product release cycle with the B100 being announced at GTC in March. Prices for the B100 will be higher than for the H100 (which will set you back around 40k USD), but I don’t think there is room for a 50% price increase unless the B100 has some design choices that make it 2-3x better than the H100.

A very notable takeaway from the earnings call was the following:

We are delighted that supply of Hopper architecture products is improving. Demand for Hopper (H100) remains very strong. We expect our next-generation products to be supply-constrained as demand far exceeds supply.

Considering that they have already been somewhat supply-constrained since 2021 (goddamned Suez canal) , when they say that they expect this to continue with a new product release they must either be extremely confident in the B100’s ability to increase productivity for the companies buying it, or the supply problems are bigger than many first anticipated. My bet is on the former.

Another interesting note is that Nvidia’s networking business, InfiniBand, grew 5x year-over-year (faster than data centers FYI), this is very interesting and I feel it at least validates the thesis that networking is a bottleneck. Good stuff for Marvell which is a long in my portfolio.

Revenue concentration

My main question after reading through the report and looking at the capex from some of the other mag7 (is it mag6 now?) is: Once all the big companies have gotten their fill of data center GPUs, who will absorb the Nvidia production? You can ask the same question of SMCI and TSMC as well, for those brave enough a short basket is revealing itself.

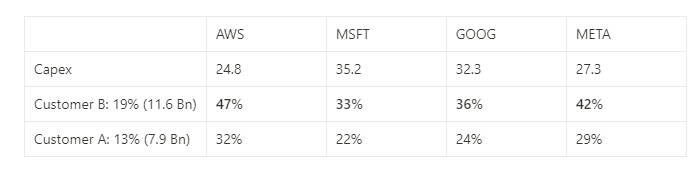

It turns out that one customer was responsible for 19% of Nvidia’s revenue last year ($11.6 Bn), which also was 24% of data center revenue. If we assume that customer is one of the hyperscalers (Amazon, Microsoft, Meta, or Google) that one company spent somewhere between 33-47% of their entire capex budget on Nvidia chips alone!!

Customer B purchases through customer A, so it’s likely that customer A is a packaging supplier, like SMCI. Firstly, let me just point out that this is wild, and whoever bought all those GPUs either reaps the rewards of them now or anticipates doing so in the near term.

Let’s pretend the customer is Microsoft, our scenario looks like this: Based on Microsoft’s reporting their AI-specific Azure products (like Azure Machine Learning Studio) are making $3.2Bn per year, which in a bastardized version of a return on invested capital back-of-the-envelope calculation equates to MSFT making a 28% return on revenue on their Nvidia GPUs purchased last year. In reality, the ROIC is likely higher, since the chips are used for other purposes in MSFT like Co-Pilot, Github, etc. The question still remains, what happens when the hyperscalers are all out of capex? For now, the capex is still increasing, but once it starts decreasing I think it is reasonable to assume that Nvidia’s revenue will take a dip as well.

The good news is that there are already some pretty big commitments to buy Nvidia equipment on the books already, and just this year there are $17 Bn booked already. Remember that at the current rate, that is a little less than a quarter’s worth of revenue. These commitments are up 54% quarter over quarter. The dropoff in commitments may seem dramatic, but I doubt serious people in serious organizations plan and commit to billion-dollar purchases for cyclical products years in advance.

So all in all this was an absolute banger of a quarter, they grew even with China GPU bans from the Biden administration, and have a pretty good gross profit margin for a hardware company amid a product launch at 74%. My reflection after reading through the 10K and looking at some of the other hyperscalers my main worry is that Nvidia’s revenue is purely mag6 spend, so I’m worried when they stop spending money we’re in trouble. On the other hand, we have not seen the truly extreme speculative behavior like in other bubbles, and if we are to believe Jensen, the world still has around $940 Bn USD of old data center infrastructure to replace with GPUs, specifically Nvidia GPUs.